Commonwealth Bank App - Accounts Redesign

Date: 2019-2021

Duration: 2 years

Tasks: UI Design and Prototyping

Tools: Sketch, Principle, AfterEffects

Deliverables: Screen designs for multiple flows and high fidelity prototypes

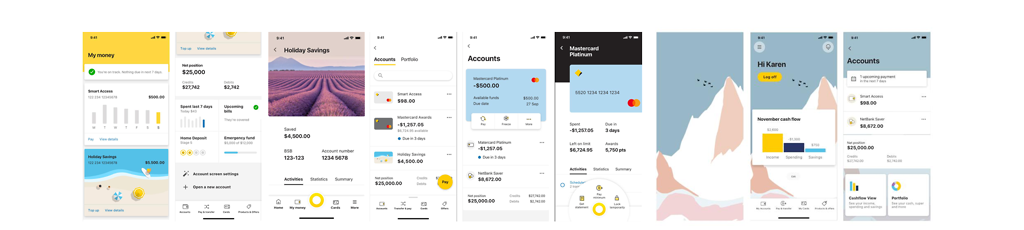

CommBank's more scannable and accessible account list in refreshed look and feel.

I was involved from the beginning to end of design processes - initial ideation workshop to resarch with customer group interviews and concept tests as well as delivering multiple features within accounts.

Key engagement numbers on Accounts screen

- 6M+ Active app users

- 130M visits per month

- 3-4 accounts on average per customer

Why the redesign?

- Since first launch in 2013, smarter banking features have been bolted on and had low discoverability. (Smart banking features are tools that help you manage or track finances using our data and engines)

- Aside from checking balances, one of the primary actions customers take when visiting accounts is to make a payment. The old design required them to return to home screen from accounts to transfer money.

What's in it for the business?

- Make the information easier to understand and act on

- Create an experience that allows smarter banking tools to co-exist in more relevant way

- Provide more discoverable actions for basic self-serve tasks like locking a card or finding a statement

What do we expect after the redesign?

- Reduced task completion time

- Positive feedback whilst maintaining number of visits and key tasks performed

With the help of research team conducting user interviews, we defined the JTBD as below:

- Check my balance before making a payment, or a decision that will affect my financial situation

- Perform key tasks for a specific account or product

- Reduce the time to check upcoming payments and understand if I have enough to cover these

- Check how my ‘every day’ money is tracking

- Check how my ‘one day’ money is tracking

- Perform secondary tasks for a specific account or product

- Track down a specific transaction that may have occurred in the past

- Reassured I’m making the most with my products

- (Related job) Alerting if customer is unprepared and providing tools to help rectify or stay on track

Other activities with the team

- Defining success metrics with PO and BA

- Workshopping vision and design principles with scrum team

- Creating roadmap with design leads, PO and PM

- Conducting co-creation session with customers

- Sketching sessions with wider design team

- Rounds of concept testings and usability testings

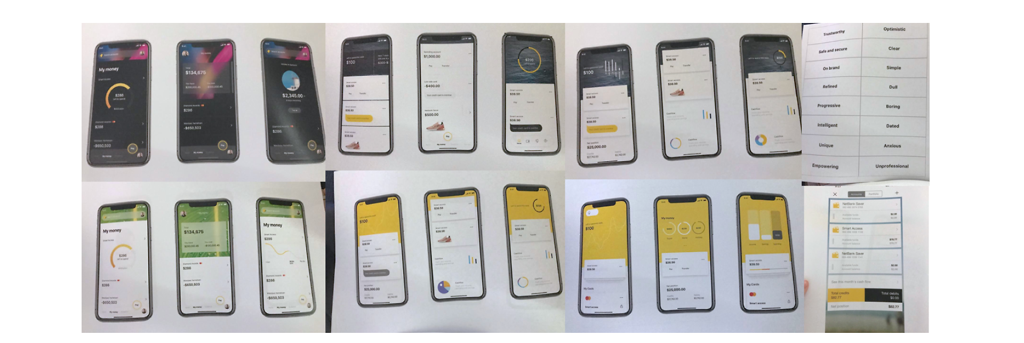

Focussing on concept testing:

- Concepts on ‘simple and intuitive’ as the app strategy and accounts vision stated and bringing wallpaper from home screen to give the screen some brand element and cohesive experience.

- Showed a wall of printed concepts where we asked customers to pick their favourites and rate out of 10, pick some features that they like or dislike, things that are helpful for them and how they’d mix and match to create a 10/10 design for them

- Gave some words on how they view these concepts

- Finally got them to score the existing design which they’re used to as well

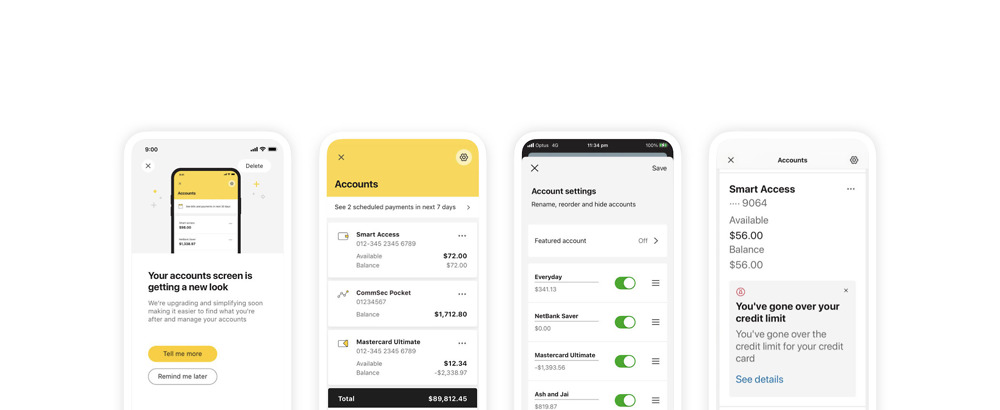

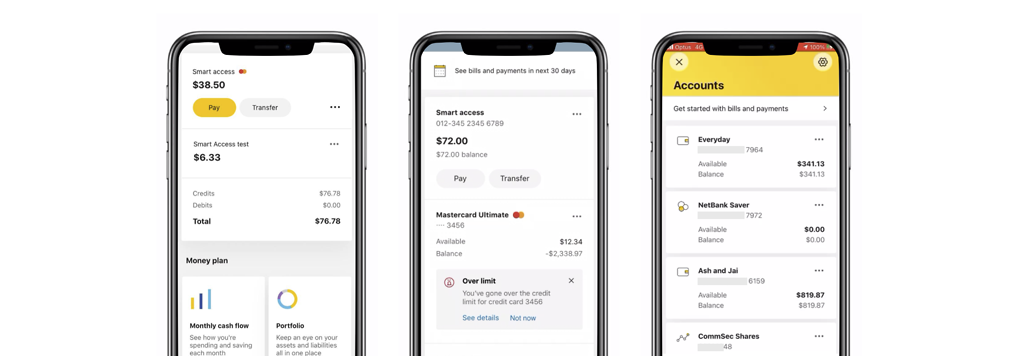

Design changes on pilot releases

From left to right:

- Minimal design that was tested with immediate team showing one balance, exposed quick actions for your most frequently rused account and showed entry point to smarter banking features

- Added more details and functionality like bills and scheduled payments reminder, contextual messaging that has Lottie animated bell, to keep customers alerted on any financially significant events, showing two balances on accounts where appropriate, mostly due to tech limitations and to cover over 200 types of products commbank currently supports

- After pilot launch and analysing feedback from customers, provided more separation between accounts by placing each account on cards and using pictograms as visual anchors